Can Salesforce Become a $1 Trillion Company?

Historical and forward-leaning perspectives on the enterprise software market, and implications for growth

Just like so many others, I got caught up in the roller-coaster of the 2020 elections so apologies for the delay in publishing this.

In the penultimate part of the Salesforce Flywheel series, I take a deeper dive into the market size for enterprise software, and the larger opportunities available for SaaS companies that are daring to experiment and expand beyond traditional boundaries.

The market has been valuing public SaaS companies at an average of 8.5x annual revenues.

For Salesforce to be valued at $1T in the future —assuming a generous 10x multiple— it needs ~ $100B in annual revenues; to command higher revenue multiples on lower revenues (say 20x on $50B) will require extra-ordinary and likely unrealistic growth rates.

Note that there have been only 4 trillion dollar companies to date (Amazon, Apple, Microsoft, Alphabet). All of them have revenues in excess of $100B, and are still growing at least 10+% in aggregate across their product portfolios.

So, is $100B in revenue even a viable long-term trajectory for Salesforce?

Salesforce’s current TAM —across enterprise application and enterprise infrastructure markets— is around $120B for CY20. Thus Salesforce would need to a) expand TAM at least four fold over time, b) while continuing to boost its aggregate market share across the markets it operates in. For an enterprise application software company to get to a TAM of $500+B with ~20% share in aggregate may sound wild and ridiculous.

But that perspective —while valid —does little justice to the underlying trends powering digital transformation and the larger reality of software eating multiple enterprise functions and industries.

To evaluate the core premise further, let us deep-dive into: 1) history and growth of the enterprise software market and why TAM has been consistently under-estimated, 2) addressable market size and market share for Salesforce in varied segments, 3) why software-driven transformation of core industries is scrambling traditional market definitions, 4) the biggest opportunities of growth for Salesforce over the next 5 years, and 5) the top obstacles for Salesforce as it navigates growth beyond $20B in its third decade.

I will discuss 1,2, and 3 below; 4 and 5 will be covered in the final part to be published later this week.

1. Enterprise Software Markets Have been Consistently Under-Estimated

From 1990 to 2020, enterprise application software spend grew from ~$1B to ~$200+B.

A short history lesson might help set the stage. In the mid-1950s, manufacturing companies started using custom-built applications and machines from IBM to run payroll, accounting, inventory control, and MRP processes. Software and mainframe hardware were bundled together, and IBM was the only player in town, so there was no separate market for corporate software.

As a fascinating aside, the hardware to run MRP could require entire rooms for the same processing power of a single smartphone circa 2016.

The market for independent software companies became a reality only when IBM unbundled software and hardware in 1969 with its general purpose S/360 family of computers; external developers now had the ability to write software for IBM hardware and sell them directly to corporations.

SAP was formed by 4 ex-IBM engineers in 1972; soon Baan, SSA, JD Edwards, Marcam, etc., all followed suit, building applications that ran on IBM mainframes. By 1990, the market for off-the-shelf enterprise application software was >$1B; SAP, now a public company, had ~ $250M in revenues and 1000+ customers.

Over the next decade, the core market for what was called “ERP” would expand to $14+B by 2000 while over-all spend across segments neared $50B; several new and emerging areas like Sales, Service, Marketing, Supply Chain, Content Management, etc. forked into their own distinct markets. By 2010, enterprise application software spend was > $100+B and the fastest growing segment within IT. The growth continued unabated into the 2010s fueled by CRM, e-Commerce, and the large-scale adoption of SaaS.

CRM is still the single largest segment within enterprise application software, growing at the fastest pace.

CRM’s stagnation and decline has been predicted by analysts at varied points over the last two decades. On top of being flat-out wrong, the reverse has been true. As enterprises seek to differentiate through customer experience, optimizing every customer interaction across marketing, sales, commerce, and support has grown paramount, leading to increased investments in the front-office.

The Demand for Enterprise Applications Drives an Additional 1.2-1.5x spend on Enterprise Infrastructure Software.

Enterprise infrastructure software has always moved in tandem with the demand for applications. This includes virtualization, security, data integration/data quality, business intelligence, development platforms, databases, and middleware.

Platform, Analytics, and Integration software have indeed become critical to translating SaaS to business and financial value. The first generation of application companies —Oracle and SAP—expanded into analytics and integration in the mid-2000s through aggressive M&A. Cloud native companies have followed the same playbook but are buying the next generation firms in these areas.

Customers are expected to spend close to $310B in infrastructure software for 2020, 50% more than application spend.

The Shift to the Cloud

Pre-SaaS, application software spend dragged along an additional 5-7x spending in adjunct markets including: a) hardware infrastructure—servers, storage, networking, b) software infrastructure—database, middleware, dev platforms, and BI software, c) implementation services, and d) hosting and managed services.

With the cloud becoming mainstream, software infrastructure, hardware, and hosting have been abstracted away by the SaaS provider, collapsing four different vendor contracts into one. The TAM for SaaS companies has thus expanded multi-fold because SaaS includes so much more than application software.

Gartner’s public cloud revenue projections draw a fascinating picture:

SaaS spend ($104B, 2020) is close to 50% of enterprise application software revenue ($209B) and the #1 growth driver. For CRM, this is 75+%.

20% of the 2020 enterprise infrastructure software spend ($310B) is cloud-based

The shift to the cloud is accelerating fast; at current rates, SaaS will be >80% of total application software spend in 5-7 years. Enterprise infrastructure software is likely to follow suit with a time lag.

Note that total enterprise software spend (~500B, 2020) is still just 1/7th of the total IT spend (~$3.4T, 2020) in enterprises. As a) IT as % of GDP continues to rise to a cross-industry average of >4%, b) more hardware, software, and IT services become PaaS and SaaS, and c) SaaS covers a broader range of industries, sub-industries, niche business functions, and geo-specific requirements, the TAM for cloud software companies may expand well beyond analyst projections.

Let us now delve into how these underlying market dynamics translate to Salesforce.

2.Salesforce’s Current TAM and Market Share

In 1999, Salesforce TAM (Salesforce Automation) was ~$1-2B; it has steadily grown over the years through a combination of M&A, organic development, and aggressive go-to-market expansion. The expansion has unfolded along three key dimensions: more products addressing more use cases, more geographies, and more customer segments.

Salesforce’s current total addressable market is ~ $120+B for CY 2020, progressing to $168+B by 2023 based on underlying market growth rates.

More than 50% of Salesforce current TAM is from CRM (Sales, Service, Marketing, and Commerce); the other 50% of the addressable market comes from enterprise infrastructure software spend, specifically on PaaS, analytics, and integration.

Salesforce market shares (see below) in enterprise application and enterprise infrastructure segments offer an interesting look into the path ahead. Please refer footnote [1] for more context on my assumptions.

Several points to note:

Extrapolating current growth rates of each market (without TAM-expanding M&A), Salesforce TAM for CY2026 will be $221B.

If growing at market growth rates (without TAM-expanding M&A) for each segment, Salesforce revenues in FY 2026 will be $35+B.

If growing at market plus 4% growth rates (without TAM-expanding M&A) for each segment, Salesforce revenues in FY 2026 will $42+B.

If we are to aggressively extrapolate 20% aggregate CAGR to FY2021-26, Salesforce revenues in FY 2026 will be $50+B. This will be inclusive of a) organic growth, b) M&A that expands TAM to new markets in enterprise applications and enterprise infrastructure, and c) M&A that increases market share in current markets.

But that is hardly the full story on the upsides. While digital transformation is upending the core offerings of several industries, enterprise software companies have not ventured beyond traditional definitions of applications and infrastructure. Yet, green pastures await those willing to go off the beaten path to follow the trail of where value is being unlocked at scale.

3.Software is Eating Many Horizontal Enterprise Functions and Industries

I wrote the following in an article on digital transformation in 2017:

Traditionally, digital projects related to the core product experience (say using a car or a home security device) are led by R&D; digital projects related to the contextual experience of the product (sales, service, support, supply chain, etc.) are led by business and IT.

As companies in traditional industries become digital businesses, these distinctions between IT, business, and R&D, and how they work together need to be fundamentally rethought.

The Totality of the Customer Experience = Core Product Experience + Contextual Experience.

This is even more true now.

Media, Marketing, and Money, are all software-driven trillion dollar industries dominated by digital-first players.

Discrete and process manufacturing verticals are being transformed by the IoT based industrial internet and real-time monitoring of capital equipment and customer assets.

Retail and merchandising are being re-imagined through robotic warehousing, machine vision, cashier-less check-out, data-driven recommendations, last-mile delivery innovations and more.

Healthcare is looking to re-invent itself through telemedicine and remote diagnostics that can deliver substantive reductions in cost of care. Insurance companies are being disrupted by pure-digital players with low over-head who are using smart devices and algorithms to better identify and manage risk, and pro-actively drive good behavior.

Can SaaS companies provide solutions in any of these areas (or) do they stay largely as enablers of the contextual experience and leave the core to digital disrupters in these industries?

Here are some examples of where SaaS companies like Salesforce can expand their territories.

Core Product Innovation

Core product initiatives have much larger budgets as they are treated as part of R&D (typically 10+% of revenues) vs. IT spend (2-4% of revenues). PaaS for R&D teams of manufacturing companies (a la Predix) or Telit are examples of possibilities in play.

As core and contextual product experiences merge, and the underlying data assets overlap, enterprise software vendors have an opportunity to help enterprises transform their core products and access R&D budgets for product development and operations.

Marketing Enjoys Massive Budgets for Demand Generation

Marketing has a ~ $1T global spend with 20+% spent on search, social, and display advertising with Google, Facebook, and other digital media. Less than 1.7% ($17B) is being spent on marketing software and intelligence circa 2020, but CMO IT budgets are growing faster than any LOB.

The use of data/intelligence for closed-loop hyper-targeting across media properties is a ripe area for growth and investment. Vendors with proprietary algorithms and software —for dynamic allocation of advertising budgets and execution of personalized campaigns —who can prove they deliver better lead generation and conversion outcomes can disrupt how marketing is planned and executed at scale.

This shift from “Marketing Services/Agencies” to software-driven allocation and execution is likely to unfold over the next 5-10 years with big $ impact. It also represents a natural convergence of Ad-tech and Mar-Tech, and a transition to selling outcomes (better lead generation and conversion) vs. selling software.

These categories do not fit traditional definitions of SaaS operating and business models. But they do represent extraordinary relevance and value for the buyer.

AI

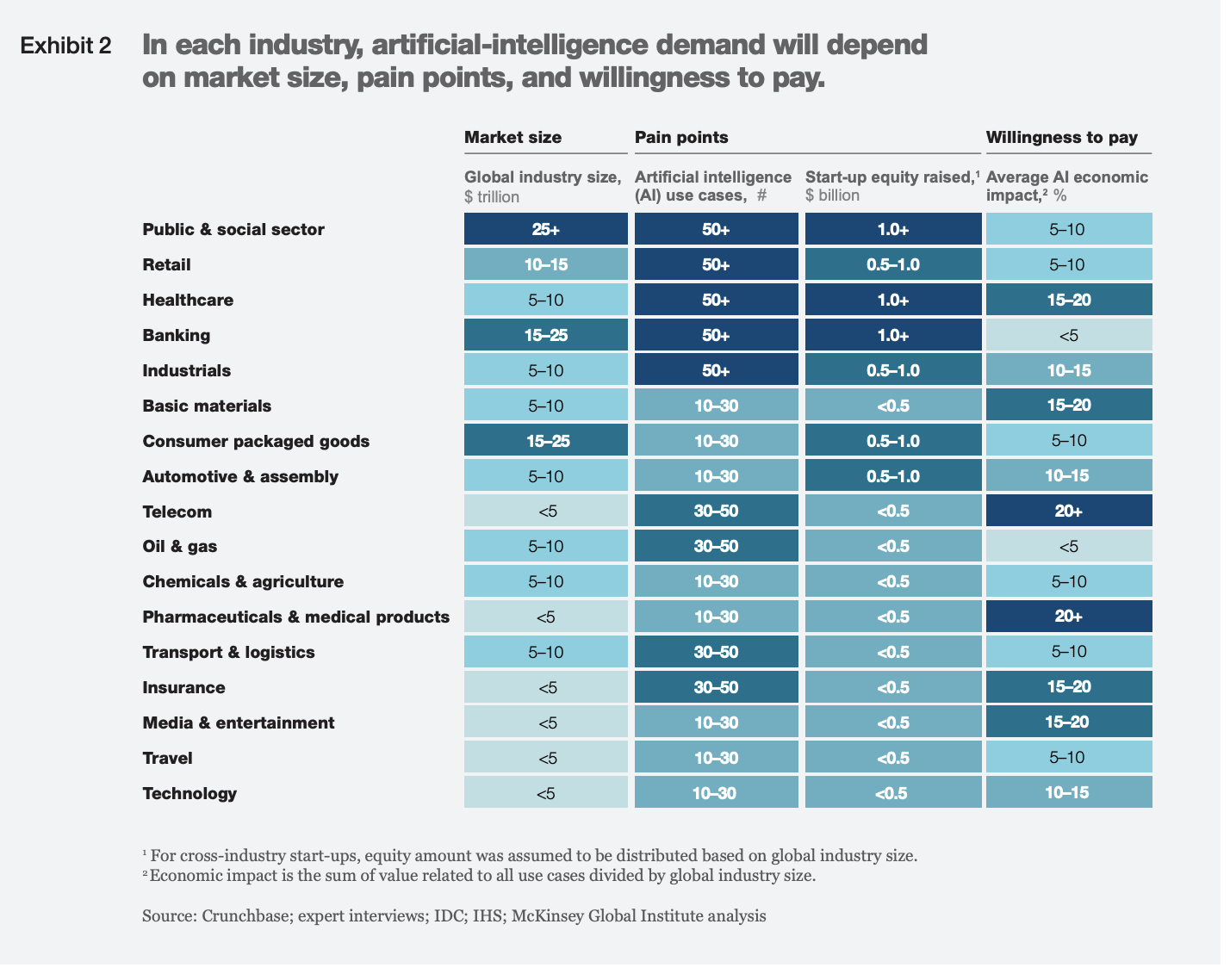

AI agents are exploding across industries and functions for a wide range of use cases (See a more detailed discussion here). Mckinsey believes economic impact will be in the trillions of $, but we are at very early stages in terms of market development. While there is inherent uncertainty on how the potential translates to actual spending on AI solutions and over what time period, this is an exciting opportunity for SaaS companies to expand into.

Industry Specific “Whole Product” Portfolio of SaaS and Supplemental Solutions

Shopify is a case in point of how SaaS companies are expanding their turfs by attacking the whole problem vs. a small sliver. A platform to help small and medium retailers build e-commerce storefronts, Shopify is seeing triple digit growths in revenue (meriting a $130B valuation at 50x sales multiple). Shopify is helping large numbers of retailers acquire capabilities that they desperately need to compete with Amazon. On top of the e-commerce product, they also provide merchants supplemental services —Shopify Capital, Shopify Fulfillment Network, Shopify Payments, etc. — that accelerate the flywheel. This diversity of product portfolio and business models makes Shopify more relevant to retailers, increasing stickiness, expanding GMV, and consequently Shopify’s share of it.

Shopify is not limiting itself to SaaS. It is providing retailers a suite of tools and services to start, run, and grow their business, both online and in-store. This vertical-specific “whole product” strategy is a veritable playbook for others.

All these examples make the point that the addressable market for successful SaaS companies is not limited to traditional analyst definitions of application and infrastructure software. Vendors can create new offers and deploy new business models to access non-IT budgets in R&D, Marketing, Finance, and Sales. Sustainable growth is a function of helping customers create better products, generate and convert demand more effectively, and deliver better experiences and economics for their customers.

Note that these are upside opportunities on top of traditional enterprise application and infrastructure markets where Salesforce can continue to expand both TAM and market share. On the basis of the above, it sounds very plausible to me that Salesforce can grow its addressable market to $500B and beyond in the next 5+ years.

In the last and final chapter, I will discuss the specific opportunities and obstacles for Salesforce to navigate in the medium term as it seeks to grow its revenues and valuation by 5x.

Foot Notes:

[1] All market size numbers are from Gartner and Salesforce investor presentations; I have made adjustments based on recent downward revisions related to Covid related declines in spending. I have assumed zero to low single digit revenue growth from CY 2020 to 21 as the worst case scenario.