PaaS is a Force Multiplier for SaaS businesses and their Ecosystems.

What is PaaS, why is it transformational, and how Salesforce pioneered this vision almost 15 years back, when the idea was neither popular nor understood.

This is the second post in the series on The Salesforce Flywheel.

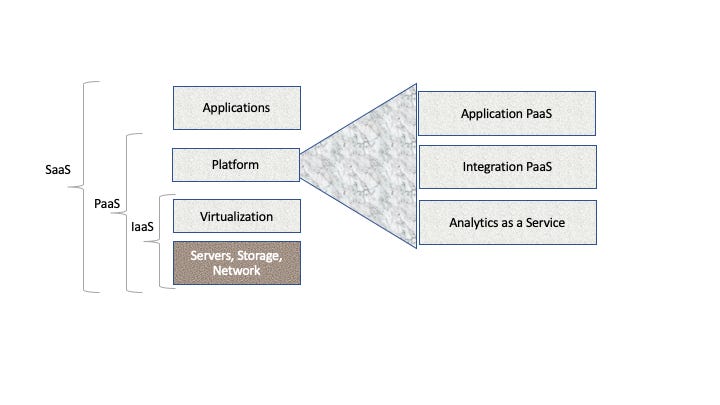

Before we discuss PaaS, it might help to engage in a brief and basic discussion of the cloud stack and where PaaS fits in.

1. As You Know, The Cloud Has 3 Distinct Layers

The bottom layer is “Infrastructure as a Service” or IaaS that provides virtualized access to compute, storage, and network resources on demand. This space is dominated by public cloud providers like AWS, GCP, and Microsoft Azure.

The sandwiched middle layer is PaaS or Platform as a Service. It is a cloud environment to develop and deploy software that abstracts away the underlying infrastructure.

The top layer —Software as a Service — refers to applications delivered over the internet and accessible via a browser or app on any device.

Every layer seeks to abstract the layers beneath. For example, end-users typically access Salesforce apps running on Salesforce instances hosted on Salesforce managed data centers (except a small percentage that run on AWS).

Before we understand PaaS in detail, let me clarify what “platform” means. It is an over-used and abused term in the industry and it is important to be precise about the definition.

2. What is a Platform?

Vendor marketing speak and tech journalists conflate platform and applications, but they are distinct and unique: If applications are cars, the platform is like the factory that makes the cars. Mass customization of cars became a reality only when sophisticated factories could make precisely configured individual vehicles on flexible production lines.

Similarly, applications represent the final products accessed by end-users on varied devices (or) channels and the platform represents the engine and framework used to build these applications and end-user experiences. Great platforms offer the following capabilities:

1/ Declarative, metadata based framework to define all aspects of the application from the user interface and experience to the business logic and database schema.

Think of the platform as a collection of lego blocks or primitives, each offering a specific functional utility. A developer can construct a great app by assembling these lego blocks vs. coding from scratch. A client can swap out lego blocks, add their own new blocks, or supplement with blocks from another developer.

The ability to assemble componentized business logic —like micro-services and APIs– into an application with minimal code makes platform-based development a powerful approach vs. code-centric models. Clients now expect platforms to support a broad range of options from no-code to low-code to pro-code to account for varied levels of complexity.

2/ The same platform is used by Engineering, ISVs, and Delivery Teams

Product engineering teams of the vendor use the platform to build standard reference applications; third party developer teams can extend standard products of the vendor or build new ones; client delivery teams can configure the platform to reflect special needs or even build custom apps. The platform makes it easier to compose, customize, assemble and release end-user apps and experiences.

3/ Support fully automated upgrades to newer versions and capabilities

Customizations within the framework are protected and ported over. New capabilities can be absorbed by current clients without massive upgrade projects that used to cost millions.

4/ Flexible and scalable

Ability to support multiple programming languages for application development, and scale based on usage.

5/ Platform based development is orders of magnitude more agile and cost effective.

A platform a) accelerates the pace of innovation by enabling higher velocity of new releases and shorter time to market for new capabilities, b) reduces costs of application development, and c) increases agility and responsiveness. And does this for all stakeholders— the primary vendor, third party developers on the platform, and clients using/developing applications built on the platform.

The hit products of yesteryears —Baan, Siebel, SAP, SSA, Oracle Apps, etc. — had underlying platforms, but only a few were truly declarative and based on open service interfaces.

With the evolution of SaaS in the early 2000s, the platform on the cloud (PaaS) became a new category in its own right.

3. The Evolution of PaaS

PaaS is like the old platform, but also so much more, because it is a development AND deployment environment on the cloud.

A PaaS has to a) completely abstract the IaaS layer from the developer, b) allow for the auto provisioning and deployment of the OS, database, and application run-time on the underlying infrastructure, c) support distributed development and dev-ops online, d) allow ALL platform capabilities to be accessible via the cloud, e) scale up and down compute and storage resources based on transaction volume, f) work across client devices and platforms, and g) yet offer personalized experiences according to user context.

Platforms built on an older generation of technologies were ill-equipped to handle this transition. But vendors like Salesforce, Atlassian, and Shopify who started natively on the cloud had an inherent advantage.

At a high level, PaaS can be trifurcated into APaaS, iPaaS, and Analytics as a Service. Each area has grown over time as the cloud continues to subsume more of the traditional IT stack every year.

Over the last decade, the definition of PaaS has grown from a “A tool for clients to customize their SaaS App” to a broad collection of technologies including low/no code application development (LCAD), pro-code development of multi-channel and device experiences (MXDP), Integration as a service (iPaaS), API Management, Analytics Platforms as a Service, and Artificial Intelligence. [1]

4.The Growth of Salesforce PaaS

Salesforce launched its PaaS for customers in 2007 and I remember being blown away after seeing a demo at the Web 2.0 conference in San Francisco. Sure, it was basic, but even then you could sense the possibilities for what it might become. By early 2008, it was opened to developers, and since then it has exploded. There are more than 5000 applications now that can be bought and downloaded from the Salesforce AppExchange, and some of them have become multi-billion dollar companies. (More on this in the next section).

PaaS and Low-Code / No-Code are hot trends today, but in the early to mid 2000s, it was far from an obvious bet. In fact, Salesforce was the first enterprise software company to create an App Store and still one of the very few. The decision to build a platform on the cloud that unleashes innovation from beyond the walls of the company has turned out to be a master stroke, creating a cascade of network effects, scarcely imaginable then.

The Salesforce PaaS is the glue that holds together the applications and the ecosystem. It also makes it possible for clients to realize value by extending standard applications, assembling capabilities from multiple vendors, and integrating with legacy/other hosted services.

The growth of Salesforce PaaS is not a linear, always up and to the right, story. It has had to deal with dramatic technology transitions in both mobile and AI, dozens of small acquisitions and a few big ones, false dawns, angry customers, and products that did not always match the promise.

Here’s Benioff, on the transition to Mobile and how many iterations it took to get it right:

“Parker, who attended this event (iphone launch in 2007) with me, had the same reaction. He called the iPhone “earth-shattering.” And he was right…”

“The next day, I told my team, we’d be redirecting our engineering resources to a new goal: turning Salesforce from a desktop company into a mobile one. Mobile functionality would have to be infused into every single product we made…. With technology advancing at a blistering pace, what got you here, as they say, isn’t what will get you there…”

“As soon as Parker and our engineering team launched this campaign, they experienced one failure after another. To work on mobile devices, the software we’d built to run on desktop computers had to be reconfigured with an entirely new technical architecture…. Our first development sprint, monumental as it felt for us, produced a mobile app that our customers basically hated. They complained that it was too clunky and slow. This failure, on top of many others, had hacked away at our morale and confidence.…”

“…In May 2014, and after several grueling years of fits and false starts, our vision for a mobile version of Salesforce had been realized. The Salesforce1 Mobile app set the standard for enterprise mobility, winning us scores of new customers, including companies like Philips and Stanley Black & Decker…”

With the acquisitions of Heroku (2010), Relate IQ (2014), Mulesoft (2018), and Tabelau (2019), and the investment in Einstein capabilities, the Salesforce Platform is now both the largest and the fastest growing business line. [2]

The Salesforce Platform is also sold stand-alone for customers looking to build custom apps. It is available in two tiers for $25/user/month and $100/user/month. Integration (Mulesoft) , Tableau, and Einstein are priced separately with multiple tiers of capabilities catering to different segments. For those wondering about the links to pricing sheets, the point is they all add up and keep the cash registers ringing. And a big reason why Salesforce is growing at 20+% at a $20B run rate, and eating a non-trivial chunk of enterprise software spend.

ISVs using Salesforce as the underlying PaaS pay anywhere from 10-25% of revenues. For the ISV, this means dramatic acceleration of time to market and access to customers through the AppExchange. Salesforce does not state revenues from ISV as a separate line item, but one interesting data point is that Veeva, with $1.2B in annual revenues, likely pays between $50M-$100+M on an annual basis. ($500M minimum pay-out agreement for 10 years until 2025).

5.The PaaS Landscape

Metal-Up vs. Application-Down

In addition to Salesforce, the two other major PaaS players are AWS and Microsoft Azure, both aggressively moving up the stack, with Google Cloud Platform (GCP) not far behind.

AWS and Azure PaaS offerings include Machine Learning, Computer Vision, Speech, IoT, Collaboration, Content Delivery, Analytics, and more.

Note that the IaaS players’s PaaS offerings are more “Metal-up” and tend to focus on a) general purpose dev environments, b) pluggable application infrastructure like components or APIs, and c) deployment services like AWS Elastic Bean Stalk, AWS Lambda, Azure Functions, etc. Salesforce PaaS in contrast is more “Application-down” and includes a richer repository of CRM centric business objects, widgets, bots, and workflows.

The Multi-Cloud Environment is Here To Stay

The convergence of these two forces from opposite directions is real and likely to accelerate. An interesting case in point is the GCP Dialogflow platform, that has been gaining significant traction. Dialogflow enables companies to build interactive and engaging text or voice-based conversational interfaces such as chatbots, using Natural Language Processing (NLP) powered by Google’s AI. (See more context from a deployment at Hulu.) Several Salesforce customers have indeed chosen Dialogflow to build customer chatbots on their websites.

Large enterprises are increasingly operating in a hybrid multi-cloud environment that may have a variety of PaaS and SaaS products —Salesforce, AWS, GCP, Azure, and more—running on different clouds. They are asking if and how they can provide compelling customer experiences— by accessing the best capabilities across vendors and consuming them as services spanning clouds.

PaaS is still in its Early Days!

The application software companies who have built successful PaaS products and thriving ISV ecosystems are almost all cloud native. They include Atlassian (4000+ Apps, >$1B in lifetime sales) , Shopify (>2800 Apps, >$280M in lifetime sales), and Business to Developer companies like Twilio and Mongo DB. The ones making serious attempts to build out a PaaS include Workday (with their Extend platform), ServiceNow, Hubspot, Intuit, etc., but these are early days for them, and Salesforce is at least a few years, or maybe even a decade, ahead of its closest competitors.

SAP, Oracle, Infor and other traditional vendors have made noises and announced products but most of it is hype than reality. To follow the rabbit hole on the PaaS landscape more, read this wonderful analysis from Sramana Mitra here.

In summary,

PaaS is a big deal. Its impact on vendors, ecosystems, and clients is transformational. It is not well understood by most buyers and hence under-valued. We need more awareness and education on PaaS among analysts, client decision makers, and vendor executives.

SaaS without a PaaS (if you are a large vendor with a proprietary platform) leaves you exposed and vulnerable against vendors who do. PaaS for customers and SIs is critical to ensure customer success, especially for larger enterprises. Developer ecosystems provide vendors a strategic control point, broader and deeper functional coverage, and a sustainable competitive advantage.

In the next section, I will cover the Salesforce ISV ecosystem, the ISV point of view, and how it plays a crucial part in powering the flywheel.

Foot Notes:

[1] More recently, Gartner has split APaaS into two separate sections: MXDPs (Multi Experience Development Platforms) for Pro-Code / X-Channel and LCDA for Low-Code.

From the Gartner MQ for MXDPs,

An MXDP is a foundational platform for developing digital apps and products that span multiple touch-points and interaction modalities for customers, partners and employees. It enables product development teams to improve their delivery and to innovate by introducing “composable experiences” to the front-end UX layer, in line with Gartner’s vision for the future of applications.

From the Gartner MQ for LCDAs,

“A low-code application platform (LCAP) is an application platform that supports rapid application development, one-step deployment, execution and management using declarative, high-level programming abstractions, such as model-driven and metadata-based programming languages. They support the development of user interfaces, business logic and data services, and improve productivity at the expense of portability across vendors, as compared with conventional application platforms."

[2] Based on Q2 2021 numbers. Platform revenue grew at 66% and is at a $6B+ run rate. Without Tableau, growth is still at 25+%.