Overcoming Invisible Asymptotes By Solving for Customers First

How Salesforce has cultivated a deep reservoir of trust with its customers, and why organizational and cultural alignment around customer success is at the heart of its virtuous flywheel.

This is the sixth part of the The Salesforce Flywheel Series, a holistic look at how Salesforce went from $0 to $20B in 20 years becoming the most valued enterprise software company.

If you like my essays, please subscribe and feel free to share with family and friends.

In last week’s post, I discussed the four key aspects of Customer Trust in B2B. Let us now review them in the context of Salesforce strategy, culture, and operating model.

Here is Benioff from his book '“Behind the Cloud”:

“We had a problem with the traditional software model that didn’t care about customers’ success. We believed that “business as service,” pursuing long-term customer engagement, was better for our bottom line. There is a Japanese belief that business is temporal, whereas relationships are eternal. That’s true…

…The cycle doesn’t end with a signed deal. Because we use a subscription-based model, we have to invest just as much effort in making our customers successful once they are signed on—otherwise they’ll leave.”

This emphasis on customer success is baked into Salesforce at an elemental level and can be traced back to its founding days. It is not empty words.

Salesforce from its very beginnings understood that SaaS —as disruptive as it might be—was still only a means to the end of helping the client realize better business outcomes. While UX has never been a strength and still continues to be a work-in-progress, the ethos to make the tech invisible to users, and focusing on the “job to be done” and the business process is an essential part of the culture.

This has made all the difference in a new era where companies are desperate to find partners for digital transformation who are willing to have skin in the game vs. those who sell software and walk away.

Salesforce is a more market-driven, and customer-driven company than engineering-first companies like Microsoft, sales-first companies like Oracle, or software-centric companies like SAP that shift the onus of customer success to systems integrators.

As Salesforce top-line has grown from $1B to $10B to $20B, almost 3/4th of incremental annualized revenue now comes from existing customers. (Source: Investor Day, Nov 2019)

Installed base expansion includes additional seats, upgrades, and enterprise license agreements (ELA)s for current clouds while new products into installed base means selling clouds or product options that are new to the customer.

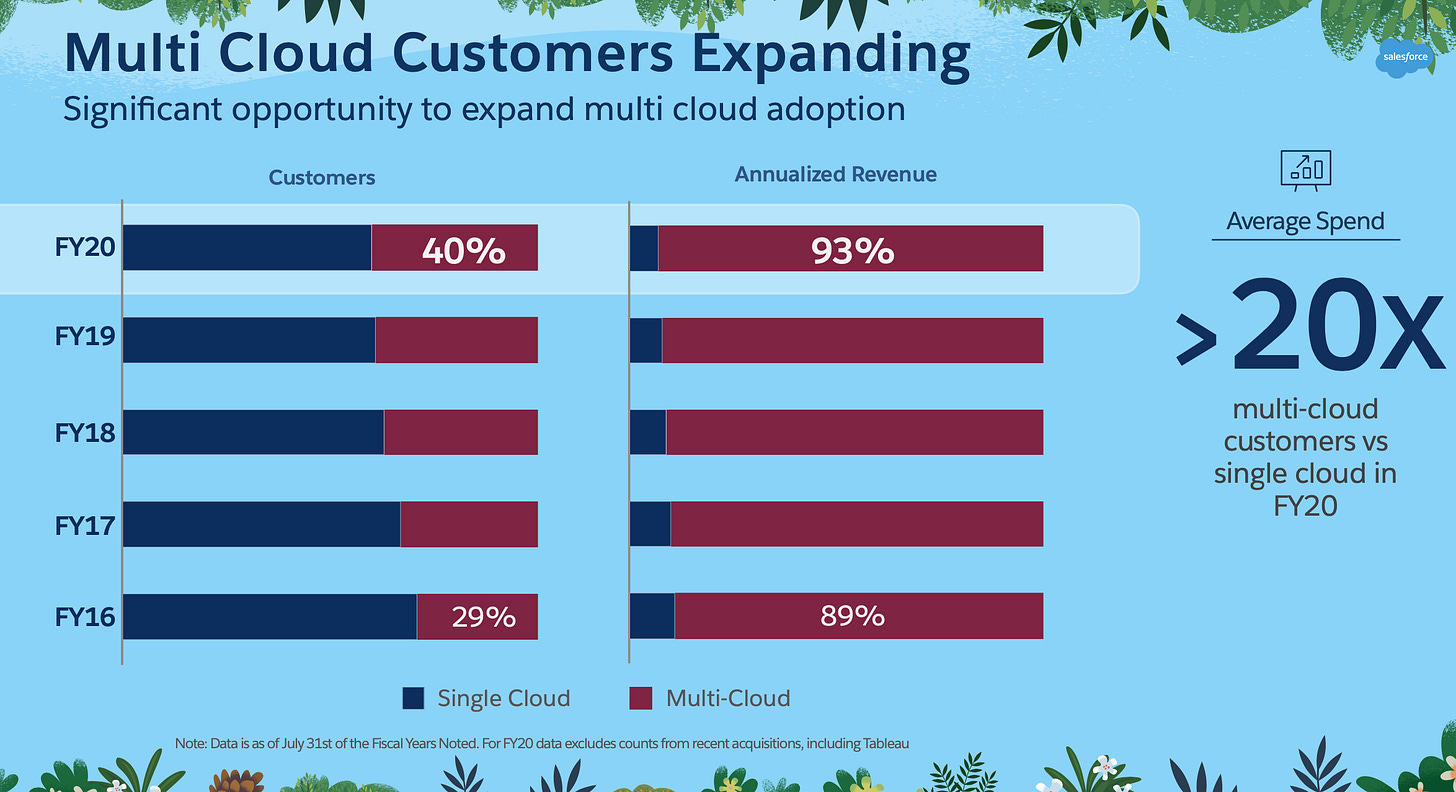

It gets more interesting when we look at multi-cloud penetration over time. Multi-cloud customers are now 93% of revenue and spend 20x more than single cloud customers.

Even though Salesforce started as a SMB play, it is now a full-fledged enterprise solution. In fact, a strong case can be made that the product has gotten too complex and pricey for the low-end.

For FY20, Enterprise (>$1M ARR) is 67% of revenues and growing at ~30% 2016-20 CAGR, compared to 18% CAGR for the non-enterprise segment. Enterprise customers demand depth of functionality, have a critical need for PaaS, desire multi-cloud capabilities, and want minimal vendor risk —Salesforce checks all these boxes and then some.

Salesforce’s biggest growth opportunities thus lie in expanding multi-cloud penetration within the enterprise. Average # of clouds for the aggregated pool of top 25 customers from each of the six major clouds (25*6=150; with de-duplication, 111 unique customers) is still only around 1.35 so there is significant room to grow. [Note: Pareto’s law explains the apparent contradiction of this vs. 93% revenue coming from multi-cloud customers]

The Customer Success Flywheel: Increasing Installed Base Expansion and Multi-Cloud Penetration

The relationship with every enterprise customer is a journey dotted with multiple milestones over time, each expanding or contracting coverage within and across clouds, based on proof of success.

Let us consider an example of a large Fortune 1000 customer and its relationship with Salesforce over time. This is a multi-cloud customer with three clouds (sales, service, marketing); each cloud has a different journey and growth path; they are sold to different buying centers with loose coordination through the CIO/CDO.

Coverage is a proxy for the % of the total addressable customer’s business (and) underlying business processes that are run and managed on the specific Salesforce cloud. Think of it as some combination of # of users, # of channels, # of products of the customer in scope, # of audiences or customer segments, # of business subsidiaries, # of channel partners, # of capabilities supported in the business process, etc.

“Land” signifies the first deal for a product line within a customer. It can even be a pilot or a project with a constrained scope to test if the product can work for the customer’s business. “Expand” signifies increases in coverage through additional licenses and/or upgrading to new tiers with enhanced capabilities.

In this example, the initial land deal —say for Sales cloud in a specific business line —spawns a chain of next steps including activation, implementation, and user adoption; the customer sees proof of success, expands coverage, and upgrades to a higher tier; also agrees to a new pilot of service cloud for a call center; Over time, the customer expands and renews contracts for both sales and service clouds, purchases a number of add-on modules, and also commences a new pilot for Marketing cloud for a specific product line and channel. As the customer is more convinced of usage and value, the coverage widens and deepens, increasing total ARR.

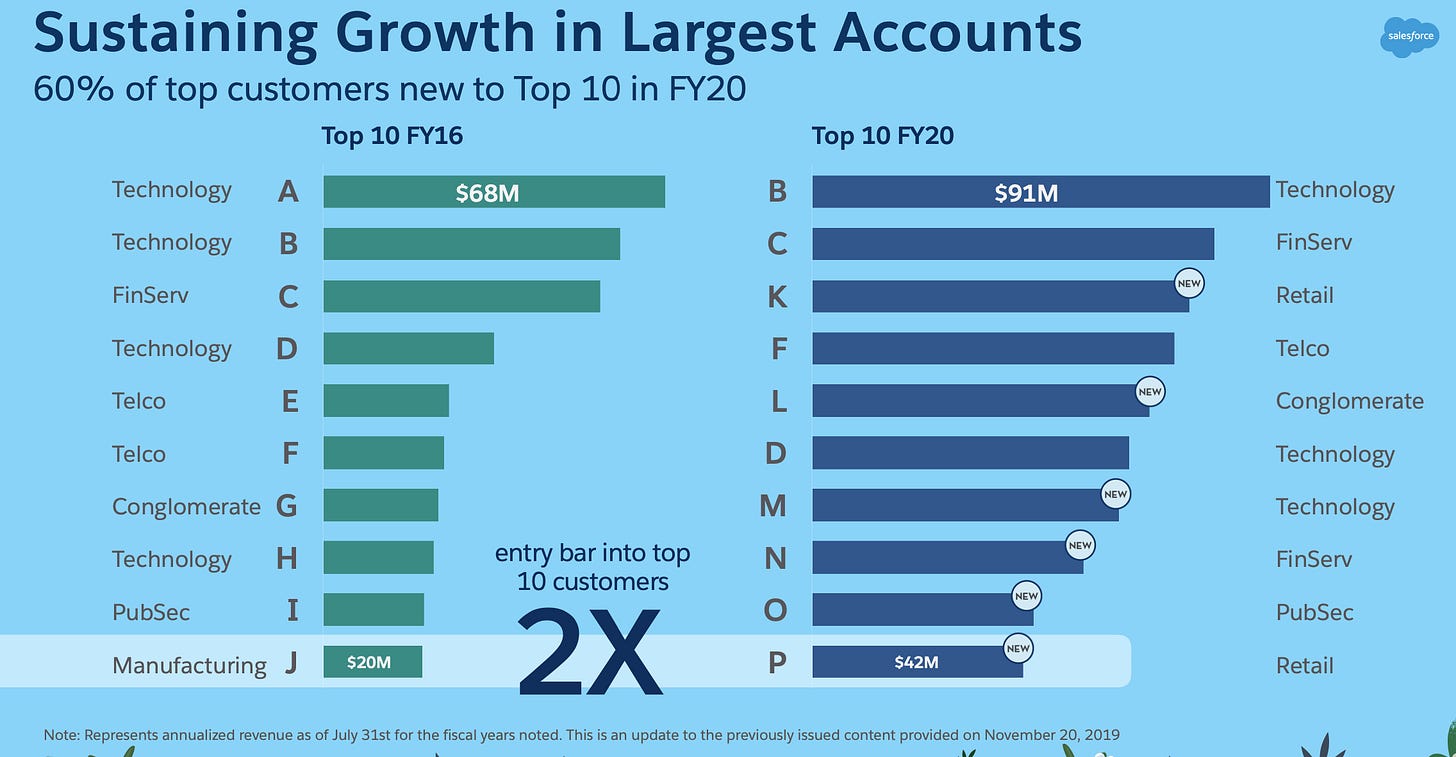

The annual spend data of the top 10 enterprise customers for Salesforce contains some eye-popping numbers (Source: Investor Day, Nov 2019).

Enterprises spending $50-100M per year with Salesforce is an even bigger deal than it appears as these are sticky relationships with significant long-term tenure. And the top 50 spend has been growing at 25+% CAGR with coverage increasing both within and across clouds.

A quick look at the pricing and this add-on list brings into sharp relief how the costs can add up really fast. Salesforce is not cheap; it comes with deep capabilities that are must needed for enterprise-grade cloud services. Enterprises justify these investments typically as a part of massive digital transformation initiatives to improve business agility and help them deliver differentiated buyer and customer experiences. As intimidating as the costs are even for a large enterprise, they are a fraction of the value the project can create if designed and executed well.

Managing Multiple LAER Cycles within Large Customers

For any large enterprise customer, there are likely multiple Land, Adoption —meaning implementation and customer success—, Expansion, and Renewal pursuits under way at any point in time for different clouds. Screwing up in one area bleeds over to others; over-selling and not following through destroys futures. The only way to succeed is to get the customer to succeed. Value captured is directly a function of value created.

Salesforce is a native SaaS company that has this ethos built into its DNA. The company knows what it means to find internal AND external alignment to make customers successful. In contrast, for several large software vendors with legacy cultures, solving for customers first is a non-trivial transformation chock full of landmines.

Overcoming the Invisible Asymptotes

Four invisible asymptotes have traditionally constrained every software company selling to large enterprises:

a) Vendor expands aggressively into new markets or domains that have high levels of complexity. Free services, immature capabilities, unprofitable deals, and wasted product development cycles slow down the company’s growth.

b) Vendor’s platform cannot meet large enterprises’ needs without significant customization. Systems integrators screw over the customer as they wrap high priced implementation services around the software. Vendor takes a potential hit to reputation as a result of high TCO and high-profile failures.

c) Vendor is unable to meet the demands and distractions of scorching growth across multiple markets. Innovation slows down exposing flanks to disruptors. Vendor pursues finance-driven M&A to drive growth, but ends with a collection of disparate products limiting synergies.

d) Vendor’s customer success and professional services efforts do not scale well. They unfavorably impact gross margins and revenue mix dampening valuation.

Salesforce is in a unique position to blow through these asymptotes —they already have to some extent—because of four key factors:

a) PaaS, b) Distributed Innovation Through Ecosystem, c) Layered and Spaced Bets Within a Coherent Framework, and d) the Customer Success Cloud.

PaaS Ensures Large Customer Success

Large enterprises often need extensive customization to account for process variability. The PaaS underlying the cloud applications provides them the ability to rapidly configure custom variants without violating core tenets of the Salesforce promise (upgradeability, low-code, time to value, etc.). A robust PaaS provides a way to develop new capabilities that are not available with the standard application. SIs and Customers who are stuck in high-complexity projects are “unblocked” and do not have to make ugly compromises because the product is closed. We discussed this more in Part 2.

Distributed Innovation Through Ecosystem

Salesforce does not venture into new domains they do not understand well or have deep domain expertise in. This is uncommon in the software industry where vendors with strong brands have not hesitated to prematurely stretch their capabilities to new markets, only to take hits to customer satisfaction. In contrast, Salesforce has let other companies in its ecosystem address industries and domains with specialized needs. (Veeva in Pharma, nCino in Banking, Financial Force in Professional Services, are all great examples). This has led hundreds of apps to bloom unfettered. Customers have come to trust that ecosystem apps will not break their Salesforce deployments and indeed enhance what they have. In some cases, the ISV is the primary app and the platform is invisible.

The ecosystem has dramatically reduced Salesforce’s direct risk in emerging markets and given it the space and time to make the right M&A moves at the appropriate times without rushing decisions.

Layered and Spaced Bets Within a Coherent Framework

A judicious mix of M&A, strategic investments, and organic development has continued to generate new clouds and add-ons at a rapid pace. Most importantly, the products are not silo’d, but complement each other, fit together into a coherent framework for the most part, and drive multi-cloud expansion within customers.

These bets on new markets have been layered sequentially over time within a coherent and evolving technology stack. Salesforce has been deliberate and thoughtful in going from SMB to SME to large enterprise; the expansion from sales to service to marketing to Commerce, CPQ, Integration, and Analytics has unfolded over two decades in tune with changes in market needs and expectations, as SaaS started to subsume all of application software.

Customer Success Cloud as a Subscription Service is a Game Changer

Salesforce has been able to bundle varied elements of customer success —training, community, success guidance, product phone support, developer support, and admin support— into tiered subscription plans (priced at 20-30% of net revenue) that have realized significant uptake. Non-subscription, one-off professional services is <6% of total revenues, the lowest in the industry, protecting gross margins.

In the next and final part of this series to be published this weekend, I will discuss the long-term growth opportunities for Salesforce, the ongoing evolution of what was once called the CRM Market, if Salesforce can become the first trillion dollar enterprise software business, and the challenges awaiting the firm in the next decade.